Retention Ratio: Definition, Formula, Limitations, and Example

Contents:

Entity normally requires to have an audit of their financial statements annually by an independent auditor. Though depreciation is a cost, which affects net income, accumulated depreciation is a bookkeeping method that does not directly affect net income. During an asset’s useful life, its depreciation is marked as a debit, while the accumulated depreciation is marked as a credit. When the asset is removed from service, the accumulated depreciation is marked as a debit and the value of the asset as a credit. The negative accumulated depreciation offsets the positive value of the asset.

Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team. The first step is to provide a proper heading to the statement. Then, mark the next line, with the words ‘Retained Earnings Statement’. Finally, provide the year for which such a statement is being prepared in the third line . To learn more, check out our video-based financial modeling courses. Similarly, the iPhone maker, whose fiscal year ends in September, had $70.4 billion in retained earnings as of September 2018.

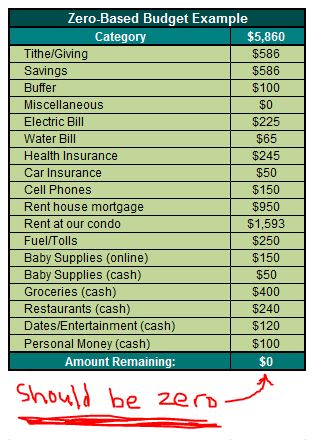

Retained earningsis the amount of net income left over for the business after it has paid out dividends to its shareholders. A business generates earnings that can be positive or negative . The retention ratio helps investors determine how much money a company is keeping to reinvest in the company’s operations. Profitability ratios are financial metrics used to assess a business’s ability to generate profit relative to items such as its revenue or assets. Shareholder equity is the amount invested in a business by those who hold company shares—shareholders are a public company’s owners.

Revenue is the income a company generatesbeforeany expenses are taken out. Retained earnings are calculated by taking the beginning balance of RE and adding net income and then subtracting out anydividendspaid. Therapy in which the goal is to help clients overcome problems by learning to think more rationally and logically. Therapy in which the main goal is to change disordered or inappropriate behavior directly. The use of drugs to control or relieve the symptoms of psychological disorders. Therapies that strive to help clients understand their thoughts, feelings, and behaviors.

Does Accumulated Depreciation Affect Net Income?

Review the company’s financial statements, including the income statement, balance sheet, and statement of cash flows, to identify the root cause of the negative retained earnings. Say your company has 10,000 shares outstanding with a par value of 5 cents and will distribute 1,000 new shares at the market price of $15 a share. The company reduces the retained earnings account by $15,000 and increases the common stock account by $15,000. When a company issues common stock to raise capital, the proceeds from the sale of that stock become part of its total shareholders’ equity but do not affect retained earnings. However, common stock can impact a company’s retained earnings any time dividends are issued to stockholders.

- On the other hand, retained earnings is a “bottom-line” reporting account that is only calculated after all other calculations have been settled.

- The Employee Retention Tax Credit can be a significant benefit for your business.

- For example, a company may pay facilities costs for its corporate headquarters; by selling products, the company hopes to pay its facilities costs and have money left over.

- Sage 300cloud Streamline accounting, inventory, operations and distribution.

- To find your shareholders’ equity (or owner’s equity) balance, subtract the total amount of dividends paid out from the beginning equity balance.

- In fact, what the company gives to its shareholders is an increased number of shares.

Revenue, sometimes referred to as gross sales, affects retained earnings since any increases in revenue through sales and investments boost profits or net income. As a result of higher net income, more money is allocated to retained earnings after any money spent on debt reduction, business investment, or dividends. The PE ratio is actually a multiple of a company’s earnings. In essence, investors are trading stock at a multiple of the expected future earnings of the company. So if a company has a PE of 5, the stock price is 5 times the most recent earnings per share (i.e., the most recent audited financial statements released to the public). Investors are buying a piece of a company’s expected future earnings when they trade based on PE ratio.

Negative Retained Earnings: Causes And Consequences

And there are other reasons to take retained earnings seriously, as we’ll explain below. Seen in this light, it has been said that retained earnings are by default the most widely used form of business financing. Obtain the company’s net income figure listed at the bottom of its income statement. Growing companies typically have high retention ratios as they are investing earnings back into the company to grow rapidly.

Depreciation allows a company to spread the cost of an asset over its useful life, which avoids having to incur a significant cost from being charged when the asset is initially purchased. It is an accounting measure that allows a company to earn revenue from an asset, and pay for it over the time it is used. As a result, the amount of depreciation expensed reduces the net income of a company.

- The Employee Retention Credit is a refundable tax credit for qualified wages your business paid to employees.

- Profits in one period flow through the operating section of the cash flow statement on their way to the balance sheet in the next period.

- And when calculating year-end yet income, we must deduct the declared dividend payments amount from the calculation.

- Retained earnings carry over from the previous year if they are not exhausted and continue to be added to retained earnings statements in the future.

A few years later, the entity might generate more sales and make its first breakeven. The bottom line might be changed from negative to positive. A company can increase the balance of its accumulated depreciation more quickly if it uses an accelerated depreciation over a traditional straight-line method. An accelerated depreciation method charges a larger amount of the asset’s cost to depreciation expense during the early years of the asset. Your retained earnings can be useful in a variety of ways such as when estimating financial projections or creating a yearly budget for your business. However, the easiest way to create an accurate retained earnings statement is to use accounting software.

What Is the Retention Ratio?

Most prepaid rent may argue that an idle retained earnings balance that is not being deployed over the long-term is inefficient. It may also elect to use retained earnings to pay off debt, rather than to pay dividends. Another possibility is that retained earnings may be held in reserve in expectation of future losses, such as from the sale of a subsidiary or the expected outcome of a lawsuit. Retained earnings are the profits that a company has earned to date, less any dividends or other distributions paid to investors. This amount is adjusted whenever there is an entry to the accounting records that impacts a revenue or expense account. A large retained earnings balance implies a financially healthy organization.

The same situation may arise if a company implements strong working capital policies to reduce its cash requirements. Growing companies often choose to avoid dividend payments and instead retain as much of their earnings as possible to help fuel their development. Retained earnings can also be used to pay off debt, and as such, some companies use their retained earnings for this purpose instead of paying out dividends. At the time that entity starts its operation, normally it is hard to make a net operating profit.

Retained earnings vs. reserves

The importance of debit retained earnings for investors lies in the fact that it provides insight into a company’s financial health and its ability to generate profits over time. Your company’s retention rate is the percentage of profits reinvested into the business. Multiplying that number by your company’s net income will give you the retained earnings balance for the period. While paying dividends to shareholders is one way to use profits, aiming for higher retained earnings can be a more effective long-term strategy for creating shareholder value.

Arhaus Is Catching Up to RH – GuruFocus.com

Arhaus Is Catching Up to RH.

Posted: Fri, 14 Apr 2023 16:26:18 GMT [source]

The statement of changes in stockholders’ equity reports ______. As with any financial ratio, it’s also important to compare the results with companies in the same industry as well as monitor the ratio over several quarters to determine if there’s any trend. Investors may be willing to forego dividends if a company has high growth prospects, which is typically the case with companies in sectors such as technology and biotechnology. Retained earnings are also the key component of shareholder’s equity that helps a company determine its book value.

Negative retained earnings are a sign of poor financial health as it means that a company has experienced losses in the previous year, specifically, a net income loss. Additional paid-in capital is included in shareholder equity and can arise from issuing either preferred stock orcommon stock. The amount of additional paid-in capital is determined solely by the number of shares a company sells. If the RE account has a Debit balance, we would call that a Deficit, and the company would not be able to pay dividends to its stockholders. Deficits arise from successive years of posting losses in excess of profits. Most financial statements today include a Statement of Retained Earnings.

When a https://1investing.in/ pays dividends, it must debit that payment to retained earnings, which means its retained earnings balance will drop by the value of the dividends it has issued. As shareholders of the company, investors are looking to benefit from increased dividends or a rising share price due to the company’s continued profitability. Investors look at the current year’s and previous year’s retained earnings balance to predict future dividend payments and growth in the company’s share price.

The income statement records revenue and expenses and allows for an initial retained earnings figure. The retained earnings statement factors in retained earnings carried over from the year before as well as dividend payments. On the balance sheet, the business’s total assets, liabilities and stockholders’ equity are visible and able to be reconciled as a result of recording retained earnings.

Northern Technologies International Corporation Reports Financial Results for Second Quarter Fiscal 2023 – Marketscreener.com

Northern Technologies International Corporation Reports Financial Results for Second Quarter Fiscal 2023.

Posted: Thu, 13 Apr 2023 12:01:48 GMT [source]

As a result, both retained earnings and shareholders’ equity are closely watched by investors and analysts since these funds are used to pay shareholders via dividends. Dividends are payments companies make to their stockholders. Since we record accumulated earnings in the RE account, all dividends must come out of that account. There are several types of dividends, but they all must come from Retained Earnings. In order to pay dividends, the RE account MUST have a positive, or Credit, balance.

Comments are closed.